Options Order Entry

Ticker: SPY

Strike: 545

Calls or Puts: Puts (going “short”)

Action: Buy to open (BUY), or Sell to close (SELL)

Order: Market (I trade market orders, not limit orders)

Quantity: Size you are trading.

1.83 is the premium of ONE contract, meaning the value is currently $183 (1.83 x 100) for one PUT contract of SPY.

If after buying this Put, the SPY goes DOWN in price, the value of the contract will go UP. Calls are opposite: Call options will go UP in value when SPY goes UP in price. (This can get confusing for beginners. Plenty of youtube videos out there on this).

Stock Chart - 544.83 Short Level

Here we see the price moves up towards a level above it (resistance), so I went short here by buying puts on as the price of SPY entered the green area of the Trade Box.

1, 3, 5 show ideal entry areas (for a short)

2, 4, 6, 7 show ideal exits (for a short)

OPTIONS CHART - 545 PUTS

Notice the charts are opposite of each other? Use the time at bottom of charts AND the numbers 1-7 highlighted to reference this.

That’s because the OPTIONS CHART is for a PUT, which INCREASES in value when the underlying asset (SPY) goes DOWN in price. Read that again…

Here, I take the first test of entry area with my “starter size” and pay out nicely on the first move.

Anatomy of a GREEN candlestick:

Note the close is higher than the open.

Anatomy of a RED candlestick:

Note the close is lower than the open.

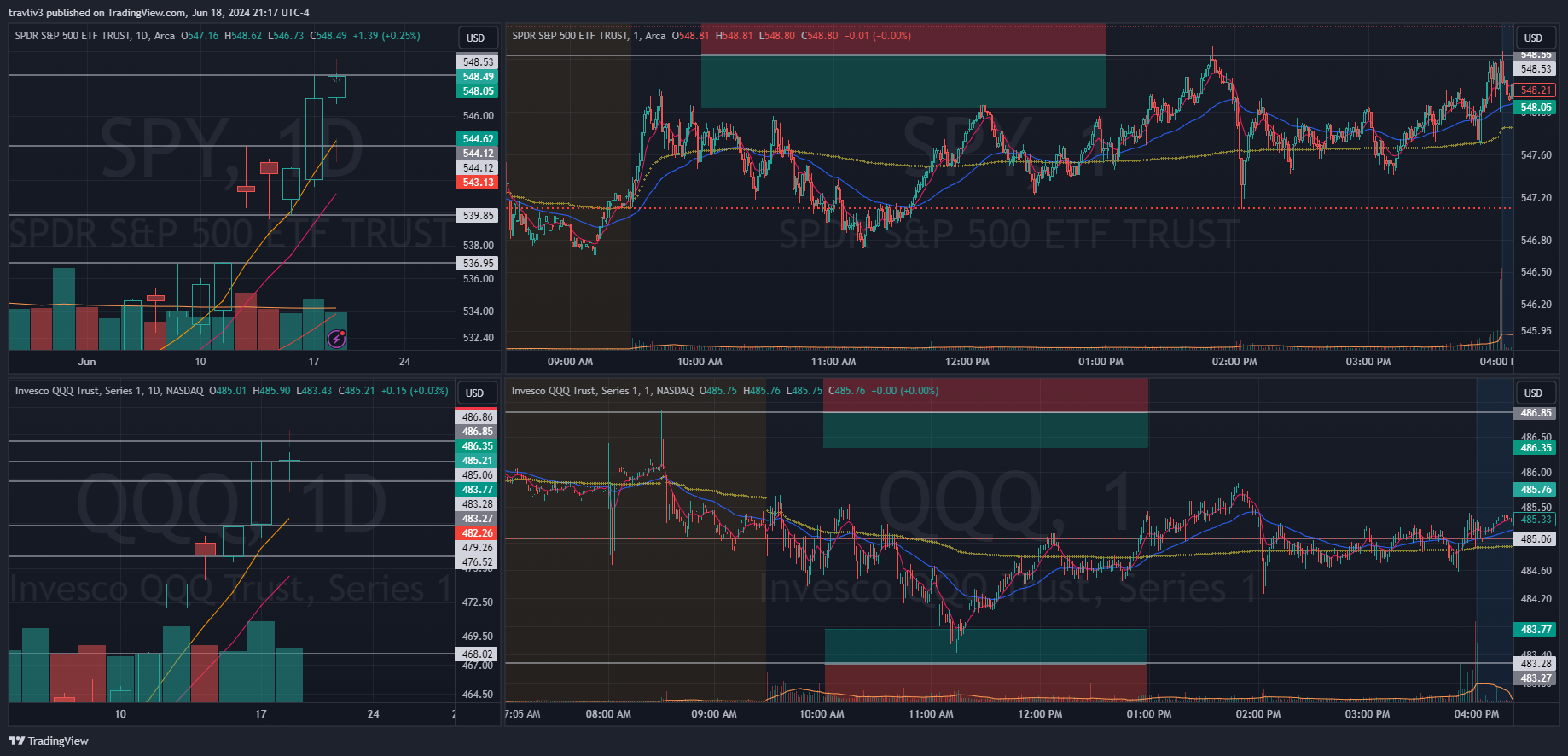

Top Left: SPY Daily Chart

Top Right: SPY 1-minute intraday chart

Bottom Left: QQQ Daily Chart

Bottom Right: QQQ 1-minute intraday chart

Checklist to consider before trade:

Speed and distance

Valid level of support or resistance

Time of day

First test of level

-

Speed and distance into the level

Valid level of support or resistance

Time of day

First test of level

Size

Risk

Things to consider once in the trade:

How to average into a trade

Where to take profit

How to manage a losing trade

How to stop out properly

Before

Trade plans are set prior to market open.

All snapshots have timestamp at top left.

The ideal long and short trade and clearly marked with both a level and trade box (red/green visualizer).

These levels are not meant to be the bottom or top for the day. I am looking to take advantage of the FIRST reaction that happens at these levels, which is usually 30-50 cents on the stock chart.

Other important levels of support and resistance are also marked.

After

Important thing here is that the plans and levels do not change.

FIRST reaction at the levels is what needs to be focused on.

Not all trades trigger, it is an instance of “if/then”.

If a trade box triggers by 10 am and my checklist is satisfied, I take the trade.

I aim to take 1 to 2 trades a morning.