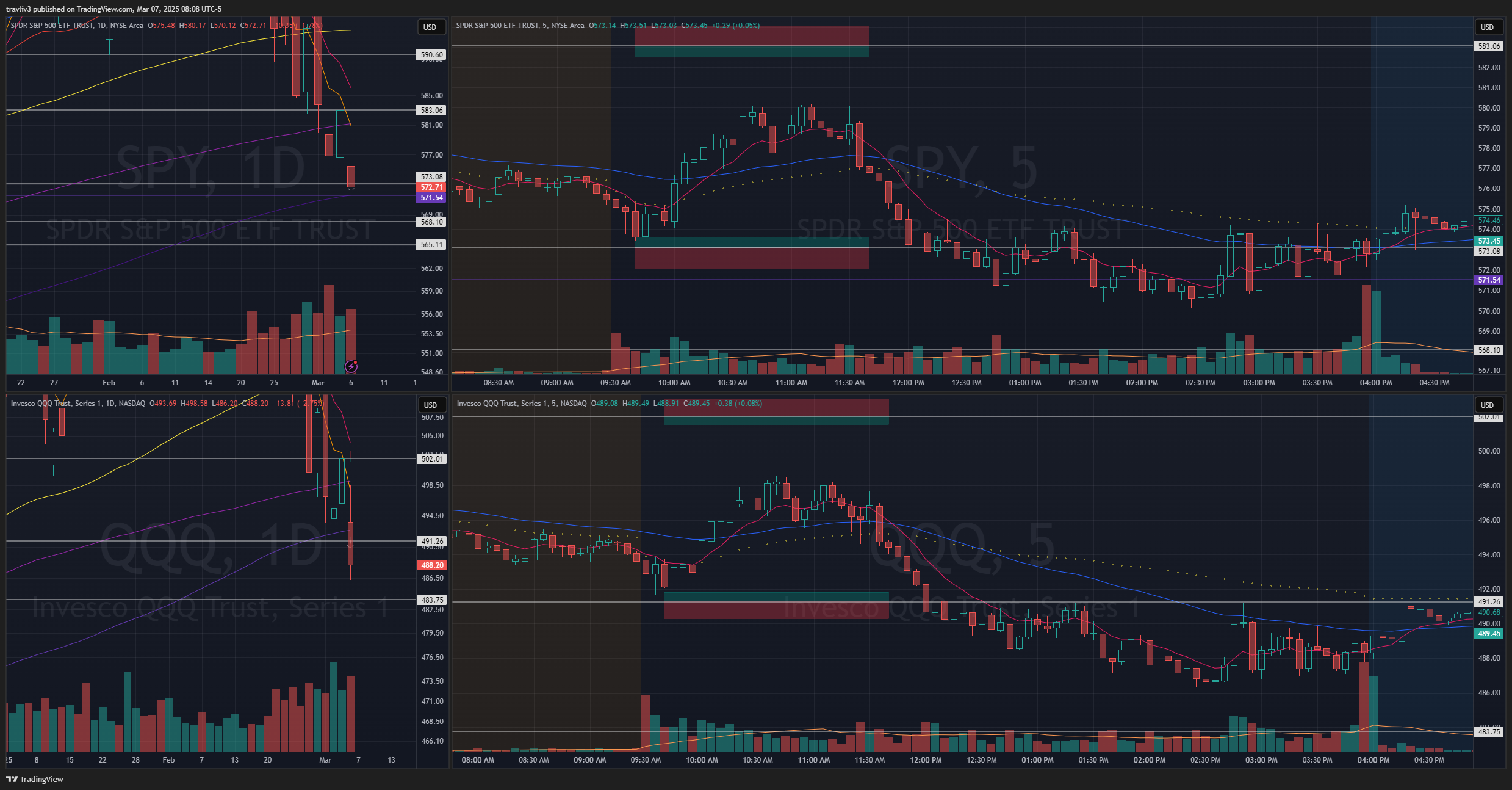

March 7

Stock charts provided by Tradingview.com

Entries charts provided by IBKR.com

Trades Taken: 4

Trade Plan

Yesterday: I took calls early on SPY yesterday on the first move down for a nice play. Market sold off from highs, broke lows.

Plan: Gap up this morning, fizzled off, numbers at 8:30 launched the price from previous close right into first short level I had marked. We’ll see where the action takes us for the open.

We’ve seen an 8 point sell off since the numbers spike at 8:30 this morning. A continued move down, and previous close can be used as a short trigger, but enough distance will be needed. A few longs marked up. SPY at 568.50 and 563.60. QQQ I like 483.85 and 477.23.

Result: Markets moved up out of the gate. Previous close was too close as I mentioned in premarket. Waited and got involved with QQQ 494 puts on the squeeze. Nice averaging here, picking my spots for adds, and getting a flush on a hard first minute there. Nice trade. I watched both markets come back down to test the previous close for a remount. I almost took this as a long, but noticed the time was right at 10:00, not worth it.

Market continued to fall and both markets triggered on long plan at the same time. I took both, getting involved with SPY 566 calls and QQQ 484 calls. Both of these long trades worked flawlessly. Price exploded soon after I got out as price retraced to test underside of previous close.

Three trades today, and 90 minutes in to market open, I caught the high of day on QQQ, and low of day on both markets (as of now). Doesn’t matter where the market ends up, it’s all about the reactions at volume zones!

(Markets sold off a bit more, alerts going off on multiple stocks coming in to levels. I took AMZN 197.50 calls for a fantastic execution of entry. Low of day here, hard push. Got my base hit on this one as always, but looking back, I nailed the bottom there.)

March 6

Stock charts provided by Tradingview.com

Entries charts provided by IBKR.com

Trades:

Trades Taken: 1

Trade Plan

Yesterday: As I anticipated, the proper levels didn’t test in my normal morning session yesterday. We did move right up to my short level to end the day. I only got a starter on SPY calls in the morning, but the patience for proper entry was excellent.

Plan: A gap down this morning, more games being played as late longs are under water this morning. I’ll admit I thought we would get a gap up this morning, but lower lows and lower highs heading into 9:00 EST. If SPY clears local lows of 573, the next longs would be 568 and 565 area. While the 200 ma hasn’t actually tested on SPY, it has on QQQ, multiple times now. QQQ, I’d like to see a break of Tuesday’s lows, 488 area, and I’d start averaging in to 483.75 range.

Result: A dip to start the morning, I got involved with SPY 572 calls for a clean base hit. Sniped break of lows multiple times, nice trend formation to pay out into as we approach the actual level, which is where we pushed nicely. Done and dusted before 10:00 numbers. We often get spikes of action at 10:00 with scheduled numbers release. My goal is to average into a predictable reaction zone and take advantage of the FIRST REACTION before these numbers are released. Sure, often times the numbers takes the trade in my favor if I had stayed in. But just as often it can/will take a green trade and turn it red. Consistent base hits is the goal!

March 5

Stock charts provided by Tradingview.com

Entries charts provided by IBKR.com

Trades:

Trades Taken: 1

Trade Plan

Yesterday: Caught three long trades yesterday morning, the third being low of day on QQQ. A hard squeeze, short cover yesterday, with action retreating at end of day to the average price (vwap).

Plan: A gap up after hours and this morning has sold off into the previous close with an hour left to go in premarket. Charts are reading wide enough for high of day for a short, low of day for a long, with previous close as the middle man. This is a traditional set up, but action has been wide. A proper test of levels may happen outside the first move this morning, levels are wide.

Result: Previous close was too close at the open, as I mentioned in premarket, it was to be used as a “middle man”. After markets broke morning lows, I got a starter entry on SPY 572 calls. By using that strike, I should point out I was wanting the price to fall to lower entry level. I was looking for an “averaging” type of play, but price jumped back up as soon as we broke lows (where I bought). Peeled my profit as we touched the underside of the previous close, which would be first target from entry point. Nice trade. Didn’t get the type of size I would have liked, but I trade what the market gives me. We didn’t hit a true entry on morning move, like I mentioned in premarket, so I was looking for a way to get involved properly. Another day of catching a 10% trade based on understanding of how these markets move.

March 4

Stock charts provided by Tradingview.com

Entries charts provided by IBKR.com

Trades Taken: 3

Trade Plan

Yesterday: Caught both markets at the previous close for a couple of nice trades yesterday before the sell off. Some of my favorite days are going long, getting out, then seeing the market failed. Knowing I can be, and often am, green on those days keeps me striving to stick to the plans. A hard sell off yesterday afternoon, going much further than expected. News/catalysts certainly affect the market. Pair that with leaders like NVDA breaking important levels, and we start to see more volatility.

Plan: QQQ tested 200 ma in premarket, hasn’t looked back since. That will be my long, proper reset on that isn’t until 486 area. There is a previous range at pm lows for SPY, but I like the long better on QQQ. Previous close for a quick short on both markets IF there is enough distance.

Result: Last 20 minutes of premarket was trending down, I took QQQ 492 calls out of the gate on first minute. Added as we approached the 200 ma and nailed the first swing up. Great first reaction trade here. Short worked well too on the counter move, but I did not take it.

Markets continued to fall during morning session. I played the average game on SPY 575 calls, willing to work in down into the 200 ma on the daily chart. Nice averaging, paying out as we retraced back to level. Also took QQQ 486 calls on extension as we were halfway between levels on speed, a nice trigger point. Markets are a deep red morning move, but I went 3 for 3 on needing the market to go up!

March 3

Stock charts provided by Tradingview.com

Entries charts provided by IBKR.com

Trades Taken: 2

Trade Plan

Yesterday: Friday we saw a late squeeze in the last two hours of the day. I caught the low on the morning dip for calls on QQQ.

Plan: A squeeze on Friday afternoon into the close continues with a decent gap up this morning. I like QQQ the best, a dip into previous close for a long, a pop into 9 ema and 516-518 for a short, albeit the short is wide. Both markets have reset longs at end of day VWAP area from Friday. I do much favor the long as we are trying to come out of a dip here. The short levels, while I am interested, could also very well remount this week to flip to support.

Note: Notice how small the risk boxes look this morning in the premarket plan compared to other days. We are getting bigger, wider moves. This adds risk. We’ve seen the red days go a little further than expected, to the next support level, before finding enough orders for a bounce. The same can happen on the way up, going higher than expected due to shorts getting hurt/stopping out, which causes buying pressure. I’m not calling for a short squeeze, simply that we should remain wide on risk for the time being. I do believe the “smart” money on the short side took profit last week on that nice sell off into major moving averages for a FIRST TEST.

Result: Market dipped quickly out of the gate (within the first minute) and popped up to premarket highs. I was not interested in premarket highs for a short, I wanted higher. Markets did indeed fail from that resistance, falling straight into the previous close on both markets with speed and distance. I bought the fear into these levels with SPY 594 calls and QQQ 508 calls. Both trades worked out very well, paying out on first reaction. Price then failed these levels and dipped hard on 10:00 numbers. We’ll see if we get proper outer level tests, or if we rip green for the rest of the day. To me, it doesn’t matter. My goal, and my edge, is the first 30 minutes of market open into a proper level. I went 2 for 2 according to plan.